Federal law requirements make it hard for people under 21 to get a credit card. Here's what you need to know as you explore your options.

Updated May 31, 2023 2:11 p.m. PDT · 2 min read Written by Melissa Lambarena Senior Writer Melissa LambarenaMelissa Lambarena is a senior writer on the credit cards team at NerdWallet. She has enthusiastically covered credit card-related topics for over seven years. Her prior experience includes nine years as a content creator for several publications and websites. Through her work, she aims to help readers extract value from credit cards to meet financial goals like stretching their budget, building credit, traveling to dream destinations and paying off debt. She explores these topics in the Millennial Money column featured in The Associated Press. Her work has also appeared in The New York Times, Chicago Tribune, The Washington Post, USA Today and Yahoo Finance, among others. Melissa has a bachelor’s degree in sociology from the University of California, Los Angeles.

Assigning Editor Kenley Young

Assigning Editor | Credit cards, credit scores

Kenley Young directs daily credit cards coverage for NerdWallet. Previously, he was a homepage editor and digital content producer for Fox Sports, and before that a front page editor for Yahoo. He has decades of experience in digital and print media, including stints as a copy desk chief, a wire editor and a metro editor for the McClatchy newspaper chain.

Fact Checked Co-written by Virginia C. McGuire Virginia C. McGuireVirginia is a former credit cards writer for NerdWallet. She is a journalist who has covered personal finance, business, real estate, architecture and design. Her work has appeared in the Philadelphia Inquirer, The New York Times, The Awl and Mental Floss.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Getting a credit card in high school won't be possible for many students. That's because credit cards have age and income requirements that will be hard to meet.

But just because you may not qualify for a credit card doesn’t mean you’re out of options. In fact, it’s important to seize any opportunity to establish credit early since it can offer financial advantages later.

As you’re researching credit cards for high school students, consider a few key basics that can set you up for success.

Technically, it's possible to get a credit card at 18 years old. But applicants under 21 will also need to have an independent income or a co-signer to qualify. Those rules don't apply to applicants 21 and older.

It all comes down to your credit scores , which are a measure of how well you've handled credit (aka "borrowed money"). If you have high credit scores, it means you're a low-risk borrower, so lenders will be more likely to give you lower interest rates and better terms on loans — such as auto loans, mortgages and, yes, credit cards.

And since the length of your credit history is a big factor in your credit scores, then the sooner you can start the clock the better.

You may not actually experience the benefits of having good credit until you're living on your own, but it will be important when you're ready to take that step. That's because landlords, employers, cell phone carriers and insurance agents can all look at your credit to make decisions about you.

Ready for a new credit card?Create a NerdWallet account for insight on your credit score and personalized recommendations for the right card for you.

GET STARTED

Most students will not qualify for a credit card in high school. For starters, merely being a student isn’t enough on its own to get you approved for a student credit card .

Federal law restricts how lenders can extend credit to young people. Those restrictions are intended to prevent young adults from running up debts that they can't repay, and they make it very difficult to get a card until you turn 21.

There are only two ways you can get a credit card before reaching that age:

Work full time. Having an income makes lenders more confident that you'll pay back borrowed money. You don't have to earn big bucks, but you probably won't qualify if you work only a few hours each week. This is one area in which high school grads who go directly into the workforce might have a leg up on those who go to college.

Find a co-signer. A co-signer agrees to share responsibility for your credit account. He or she is on the hook if you don't pay the bills, so you'll probably want to ask a parent or another close relative who trusts you to use the card responsibly — and who has good enough credit to qualify. Not all credit card companies allow co-signers, so check out our list of issuers that do .

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Learn MoreIf you can meet the general requirements to qualify for a student credit card, here are some beginner-friendly options that report payments to all three credit bureaus , which are the companies that assemble the credit reports that form the basis for your credit scores.

The $0 -annual-fee Discover it® Student Chrome is one of a few student credit cards that don’t require a FICO credit history to qualify, so that's one less obstacle on the path to credit. It earns 2% cash back at gas stations and restaurants on up to $1,000 in combined quarterly purchases and 1% on all other purchases.

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

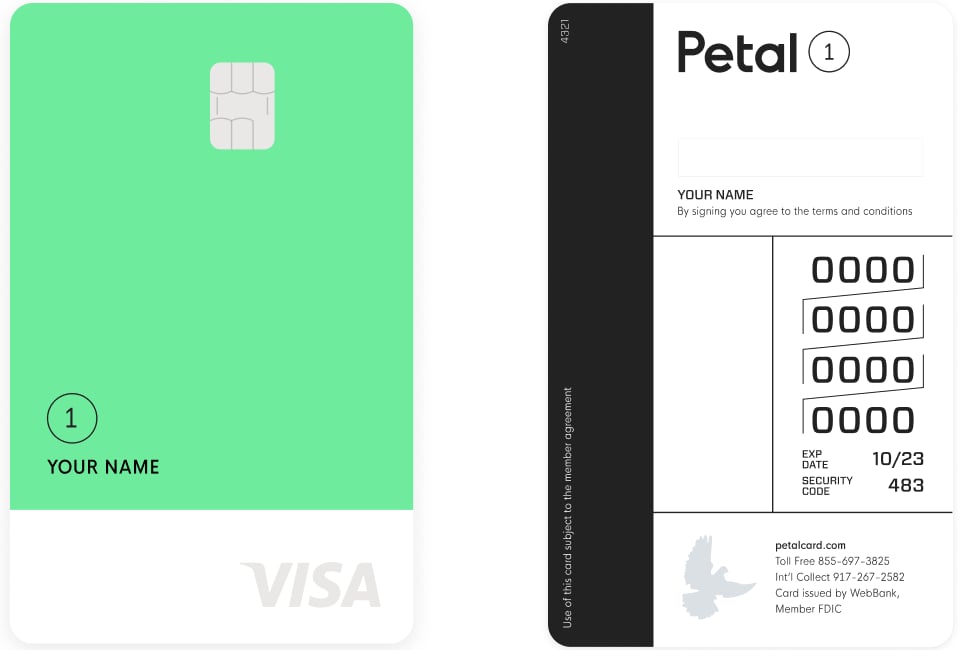

Learn MoreThe $0 -annual-fee Petal® 1 Visa® Credit Card earns up to 10% cash back when you use the card to make purchases with select merchants. You don’t need a security deposit or credit history to qualify, but you may need to link a bank account. Petal's issuing bank, WebBank , uses an algorithm that looks beyond credit scores, analyzing banking data to get a full view of how you manage income, savings and spending.

NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Learn MoreThe $0 -annual-fee Capital One Platinum Secured Credit Card is one of a few credit cards with a potentially lower security deposit requirement, depending on eligibility. It offers a $200 credit line with an initial deposit of $49, $99 or $200, for those who qualify. It doesn’t earn rewards, but that's not the priority when you're just starting out with credit.

If you can’t get a co-signer, you might still be able to use someone else's strong credit history to build your own by becoming an authorized user on a friend or family member's existing account.

In this situation, you receive a credit card with your name on it that's tied to the friend or family member's account. The account holder is responsible for paying the bills, but you can potentially work out an unofficial payment agreement with the account holder.

Not all credit card issuers report authorized user activity to the credit bureaus, so it's a smart move to call the issuer and ask. Even if the issuer does report payments, payment behavior won't have as great an effect on your credit score as it would if you owned the account. Still, every little bit helps when you're starting. And it's a way to practice using a card and building good credit habits.

Once you have access to a credit card, using it wisely will help your credit. Here are a few habits that can put you on a good path:

Keep the card open and active. An inactive account can get closed by the issuer and have a negative impact on your credit scores. Make at least one small planned purchase each month to keep it open.

Don’t let your balance carry over to the next month. Paying off your full balance each month avoids interest charges and debt over time. If you must carry a balance, try to use under 30% of your available credit to minimize the impact to credit scores.

Pay your bill on time. Making at least the minimum payment by the due date every single month will keep your credit history on track.

Don’t overspend to earn rewards. If your credit card offers rewards, it’s only worth earning them on planned purchases that align with a budget. If you overspend, any interest accrued will cancel out the value of rewards.

Set a calendar reminder to review your statement weekly. By checking in with your finances often, you’ll be aware of expenses and what's truly affordable. You can also spot fraudulent charges and report them on time to avoid unnecessary headaches.

About the authorsYou’re following Melissa Lambarena

Visit your My NerdWallet Settings page to see all the writers you're following.

Melissa is a credit cards writer at NerdWallet. Her work has been featured by The Associated Press, New York Times, Washington Post and USA Today. See full bio.

You’re following Virginia C. McGuire

Visit your My NerdWallet Settings page to see all the writers you're following.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105